Legislative Acts

Bitcoin Strategic Reserve Initiative

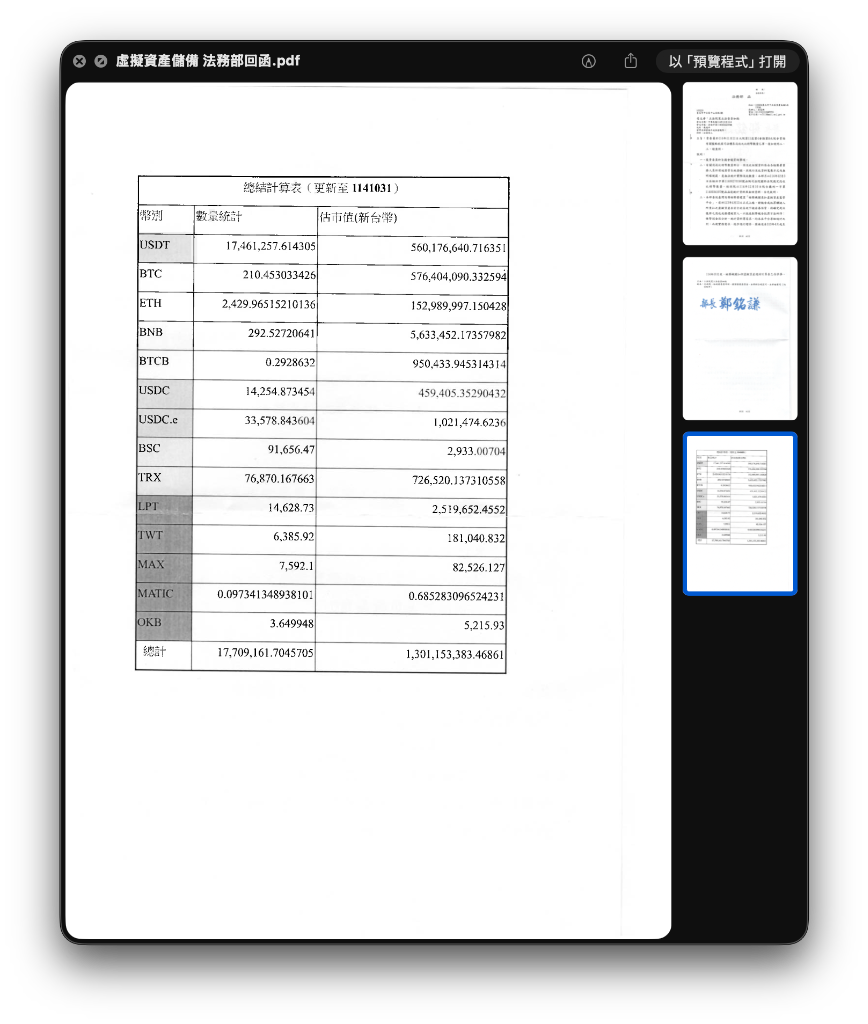

Latest Update: Ministry of Justice Audit Results Released – Taiwan Ranks 8th Globally in Bitcoin Holdings (2025.12)

Following strong inquiries and demands from Legislator Ju-Chun Ko, the Ministry of Justice has completed the audit of seized digital assets. As of October 31, 2025, Taiwan holds over 210 Bitcoins. According to CoinGecko statistics, this holding ranks 8th among world governments, demonstrating significant strategic potential.

📥 Download Official Document: Virtual Asset Reserve MOJ Letter.pdf

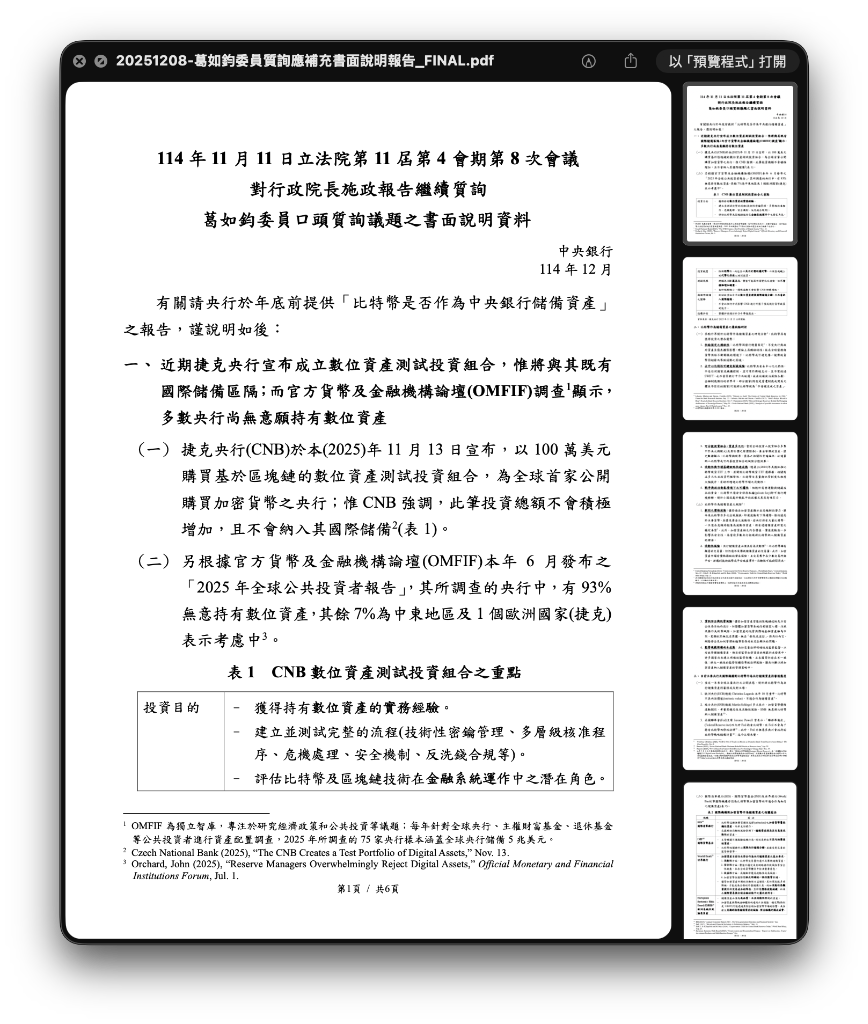

Exclusive Update: Central Bank Releases Latest Report on ‘Bitcoin as a Strategic Reserve Asset’

In response to multiple inquiries by Legislator Ju-Chun Ko, the Central Bank officially released a supplementary explanation report in December 2025. The report presents both pros and cons, mentioning that the Czech National Bank has included cryptocurrencies in its investment portfolio for testing, but also noting that according to an OMFIF survey, most central banks currently remain reserved.

📥 Download Full Report: 20241111-葛如鈞委員質詢應補書面說明報告_FINAL.pdf

“Bitcoin is not just an asset; it is the battlefield for national financial sovereignty in the 21st century.”

In view of global digital asset trends and the rapid changes in geopolitical and economic situations, I (Ju-Chun Ko) have repeatedly inquired and advocated in the Legislative Yuan that the government should carefully evaluate the possibility of including Bitcoin in national strategic reserve assets. This is not only to diversify risk but also to ensure that Taiwan does not fall behind in the global digital arms race and secures its competitiveness in the future financial system.

Core Initiative: Three Arrows for Taiwan’s Digital Asset Strategy

I have repeatedly emphasized in the Legislative Yuan that virtual assets should not merely be viewed as speculative commodities but as a new battlefield for “National Security” and “Financial Sovereignty.” Addressing Taiwan’s current situation, I propose three concrete demands:

1. Audit Holdings

“This is Taiwan’s existing ‘first pot of gold’.” “This is Taiwan’s existing ‘first pot of gold’.” After urging the Executive Yuan and the Ministry of Justice to conduct a comprehensive audit, it has been confirmed that as of October 31, 2025, the amount of Bitcoin seized by Taiwan’s judicial authorities has reached over 210 BTC. According to CoinGecko data, this holding currently ranks 8th in the world.

- Next Step: Ensure that these assets are not easily auctioned off and establish a unified digital asset ledger for management.

2. HODL Strategy (Hold On for Dear Life)

“Selling now is giving away future appreciation.” For confiscated digital assets, I suggest adopting a strategy of “priority holding, no auction for now.” Unless the national treasury has an immediate need for funds, these should be viewed as potential reserve assets to be disposed of only after regulations are complete.

- Strategic Significance: Just as the US government has accumulated approximately 200,000 Bitcoins through law enforcement actions, Taiwan should learn from this strategy and transform confiscated assets into strategic reserves.

3. Incorporate into Strategic Reserve

“Instead of betting everything on the US dollar, diversify the risk.” I call on the Central Bank to list Bitcoin as one of the options for “National Strategic Reserve Assets,” with a target of 0.1% of GDP or a certain percentage of foreign exchange reserves.

- Purpose: To hedge against US dollar inflation risk and diversify the traditional foreign exchange structure that is overly reliant on US debt.

- Progress: Premier Cho Jung-tai and Central Bank Governor Yang Chin-long have promised to submit a relevant inventory and assessment report by the end of 2025.

Why Push for This Now? Strategic Rationale

1. Risk Hedging: Reducing Single Reliance on the US Dollar

Taiwan’s foreign exchange reserves are highly concentrated in US dollars and US debt. Facing the risk of US debt expansion and potential decline in US dollar purchasing power, Bitcoin, as “digital gold” with a fixed total supply, possesses hedging functions with low correlation to the traditional financial system.

2. International Alignment: Not Absent from the Global Digital Race

The United States (Proposals from the Trump administration and Senator Cynthia Lummis) has viewed Bitcoin as key to maintaining national financial leadership; countries like El Salvador and Bhutan have also deployed ahead. As a technology island with strong semiconductor and cybersecurity capabilities, Taiwan should not be absent from the global digital arms race.

International Trends and Geopolitical Background (2024-2025)

Global awareness of Bitcoin has risen from “private investment” to the level of “national strategy.” Geopolitical instability (wars, sanctions) has accelerated countries’ demand for “censorship-resistant” assets.

USA 🇺🇸

- Relevant Dynamics and Strategic Intent: Trump Admin / Senate Push: Views Bitcoin as a strategic asset, intending to consolidate USD hegemony and lead digital financial rules.

- Key Data/Bills: BITCOIN Act of 2025: Proposes the federal government purchase 1 million Bitcoins (approx. 5% of total supply) over 5 years and hold for at least 20 years.

El Salvador 🇸🇻

- Relevant Dynamics and Strategic Intent: First Mover Advantage: Continues daily purchase of 1 BTC and utilizes volcanic geothermal energy for mining, establishing Bitcoin as legal tender and reserve.

- Key Data/Bills: National treasury holds directly, and attracts foreign capital through issuing “Bitcoin Bonds.”

Bhutan 🇧🇹

- Relevant Dynamics and Strategic Intent: Energy Monetization: Utilizes abundant hydropower resources for mining, quietly accumulating massive Bitcoin reserves.

- Key Data/Bills: Daily output of 1~5 BTC, estimated holdings exceed 13,000 units.

Corporates

- Relevant Dynamics and Strategic Intent: Asset Allocation Normalization: Companies like MicroStrategy demonstrate the “Treasury Strategy” of converting cash reserves to Bitcoin.

- Key Data/Bills: Total Bitcoin holdings by global public companies continue to hit new highs.

Key Insight: Bitcoin’s decentralized nature makes it a “neutral reserve asset” in modern geopolitical games.

Related Reports and Multimedia

🇺🇸 Deep Dive: US “Bitcoin Strategic Reserve Act”

This interview delves into the details and political maneuvering of the US Strategic Bitcoin Reserve Act (BITCOIN Act), offering great reference value for understanding US policy logic. Senator Cynthia Lummis discusses it from the perspectives of “National Financial Security” and “Debt Hedging,” which serves as an important reference for our policy advocacy in Taiwan.

📰 News Tracking

- 2025.11.13 Blockcast: “Ko Ju-Chun urges assessment of Bitcoin reserves and audit of Taiwan’s holdings! Executive Yuan and Central Bank promise to report by year-end”

- 2025.11.12 SETN: “How much Bitcoin does Taiwan have? Tech Legislator Ko Ju-Chun urges quick audit; Premier Cho: Report by year-end”

- 2025.03.14 Crypto City: “Legislator Ko Ju-Chun reveals Taiwan’s Bitcoin strategy! Suggests using 0.1% of GDP to buy coins; we have 3 major advantages”

🔗 Official Zone

For more details and full policy discourse, please visit: Bitcoin Strategic Reserve Initiative

📖 Extended Reading: Blog Post

Learn more about the global Bitcoin strategic reserve trend: [Dr. Ko] Bitcoin Strategic Reserve: The New Global Digital Asset Landscape and Taiwan’s Critical Next Step

Next Steps: Continued Supervision and Advocacy

Based on the Executive Yuan’s promise to submit a report by the end of 2025, I will take the following actions:

- Advance Request: Request the Central Bank and Ministry of Justice to provide “preliminary audit data” and an “assessment report outline” to grasp the direction of the discourse.

- Defensive Preparation: Prepare counter-arguments and international hedging cases against potential conservative viewpoints (such as emphasizing only volatility risk) from officials.

- Consensus Building: Continue to build consensus through inquiries and social communication, letting more citizens and officials understand the strategic value of Bitcoin reserves for Taiwan’s future.

Your attention and support are the greatest driving force for promoting this forward-looking policy. Please continue to follow this page and my social media for the latest progress.